|

|

|

|

|

|

|

|

|

|

|

|

_

|

|

The Monthly Consumer Survey from BIGinsight™ monitors over 8,000 consumers each month providing unique insights & identifying opportunities in a fragmented and transitory marketplace.

Talking Points:

- Springing sentiment stalls in April

- Consumers zeroing in on just the necessities

- Decreasing overall spending increases 20%+ from March

- End-of-April pump price prediction? $4.17/gal

- Third time’s a charm for Kohl’s in Women’s Clothing

- Payless loses footing to Walmart in Shoes

- BIG Ticket: Are consumers trading in for better fuel economy?

- What’s Hot? Play ball! And, back away from those printed jeans…

|

|

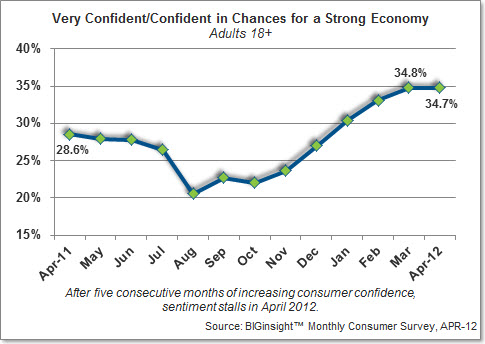

Springing sentiment stalls in April…while more than a third (34.7%) assert they are very confident/confident in chances for a strong economy, this figure remains unchanged from March (34.8%) and ends a five month streak of consistent improvement. This month’s reading remains elevated from Apr-11 (28.6%), though falls well below pre-downturn Apr-07 (46.5%).

With the official U.S. Unemployment Rate holding relatively steady at 8.2% in March, consumers remain firm on their month-over-month outlook for the labor market as well…nearly one in four (24.0%) predicts that “more” pink slips will be handed out over the next six months, mirroring last month (23.9%), though down four points from a year ago (28.5%). The majority (53.7%) feels that layoff levels will remain the “same,” up two points from Apr-11 (51.7%), while one-fifth (22.3%) is expecting “fewer,” slightly more optimistic compared to one year ago (19.8%).

And, those fortunate enough to be employed feel fairly secure at their current places of employment: just 3.1% is worried about becoming laid off, lowering from last month (3.8%) and remaining well below the April high set back in 2009 (8.1%).

With Rick Santorum out of the Presidential picture, the race to the White House is sure to heat up soon, though for the time being, consumers are taking matters of nationwide importance in stride…in April, 19.8% contend they are worrying more about political and national security issues, down a point from March (20.7%) and deflated from Apr-11 (22.2%) as well.

|

|

Practicality when spending remains a priority for the majority (50.8%) in April, though this figure slipped half a point from last month (51.3%). And with pragmatic purchase intentions remaining elevated from a year ago (48.8%) as well as Apr-10 (50.3%), it appears that rising gas prices might be keeping this figure pumped up for the foreseeable future.

Consumers have their eagle eyes trained on just the necessities…this month, 58.6% say they zero in on just what they need when at the store, rising two points from last month (56.8%) and putting the figure in range of recession-era Apr-09 (59.5%) and Apr-10 (59.4%).

Retailers could experience a sales drought this summer with decreasing overall spending the current fiscal priority…this month, two in five (39.8%) plan to make monetary cutbacks, which is at levels we saw back when we were facing two other fuel-related crises: Hurricane Katrina (Sep-05 = 40.0%) and record-high gas prices (Jul-08 = 39.2%). [Coming off of the disastrous 2008 holiday shopping season, Jan-09 is the titleholder for the all-time high (42.9%).] More than a third (34.7%) plans to pay down debt, rising from a year ago (31.9%), while increasing savings is a priority for 30.1%, up from Apr-11 as well (28.3%).

With gas prices thisclose to $4/gal, drivers are [obviously] taking notice…look for consumers to take fewer trips to the store (47.7%), shop closer to home (43.9%), shop for sales more often (39.3%), use coupons more frequently (35.4%), and try out store brand/generic products (32.9%) as means to defray increasing fueling expenses.

Consumers are attempting to decrease their overall spending, but will inflating price tags get in their way? Read more: Up, Up, and Away: Consumers Talk Rising Prices.

With 74.2% predicting that the pain price at the pump will climb higher by the end of April, retailers should expect shoppers to keep the brakes on exorbitant spending…just one in five (21.6%) anticipates that the cost of fueling up will remain in the near $4/gal range, while a scant 4.2% is expecting a decline. Consumers forecast an average pump price of $4.17/gal by the end of April, slightly higher than the price predicted for the close of March ($4.08/gal).

For more on this high-octane topic, head over to the BIG Consumer Blog to read our special series: Pain at the Pump.

|

|

Will the third time be the charm for Kohl’s long-term top standing in Women’s Clothing? For three consecutive months now, the department store darling has led the feminine fashion segment, with 13.4% shopping there most often in April. Walmart plays second fiddle at 11.5%, while Macy’s (10.0%), JC Penney (8.6%), and Target (3.0%) round out the Top 5. Price (67.3%) is the main motivating factor behind shopping a particular store most often for Women's Clothing…selection (56.0%), quality (45.5%), location (42.6%), and coupons/special sales (22.3%) also prove popular.

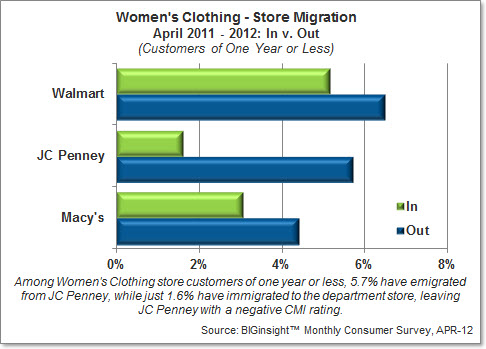

So how might Kohl’s fare in the long run? Will Walmart make a Women’s comeback? According to this month’s Consumer Migration Index (CMI), which tracks those who have immigrated to a store (new customers within the past year, “In”) against those who have emigrated (left within the past year, “Out”) and where a positive rating spells net growth to a retailer, the big discounter will have to shore up its leaky customer base in order to buoy back to the top spot (CMI = -1.3)…Macy’s is suffering a CMI deficit similar to Walmart, while JC Penney has been hit fair and squarely with a -4.1 CMI. (Note: Kohl’s did not register enough “emigrating” customers to calculate a CMI, so one can assume a positive CMI rating for this retailer.)

While it might be a bit premature to evaluate the full impact of JCP’s “Fair & Square” promotional strategy on the department store’s customer base, we do know that Women’s Clothing shoppers of one year or less cited high prices (18.0%) as the top reason to stop shopping a particular store most often. Inconvenient location (10.0%), poor selection (6.2%), lack of coupons/special sales (5.0%), and unavailability of correct sizes (4.9%) were also key factors.

BIGinsight special: New analysis of the top retailers for Women's Clothing shows that departments stores are the most buzzed about by customers...read the blog.

And, for more on consumers’ reactions to JC Penney’s new promotional strategy: “Fair is Fair” but is Square…well…Square?

There’s always a little less drama over in the Men’s section, isn’t there? This month, Walmart (15.4%) maintains a three point lead over Kohl’s (12.2%) as the store shopped most often for this category. JC Penney (8.7%), Macy’s (6.8%), Sears (3.0%), and Target (also 3.0%) follow.

Walmart also continues to lead over in Children’s, with 12.4% shopping the big discounter most often for pint-sized apparel. Kohl’s (6.3%), Target (5.1%), JC Penney (4.1%), and Gap (2.6%) trail in the single digits.

Payless loses its foothold in footwear for April…the discount specialty store – last month’s victor in Shoes – slips to #2 with 10.2% shopping there most often and lands behind Walmart (10.8%) once again. Kohl’s (6.8%), DSW (4.3%), and JC Penney (3.9%) round out the Top 5.

Best Buy remains fully charged in Electronics…more than a third (34.4%) shop the big box most often, followed by Walmart (20.3%), Amazon.com (7.9%), Target (3.5%), and Sears (2.0%).

Home Depot –recently welcoming springtime DIY with Black Friday themed promotions – tops the Home Improvement/Hardware category this month with about one in three (32.3%) shopping there most often...more than a quarter (26.7%) head to Lowe’s, while Walmart (6.2%), Menards (3.9%), and ACE Hardware (3.1%) complete the Top 5.

While traditional grocers (57.9%) are collectively the preferred format for foodstuffs over discounters (24.3%), that one big discounter still has this category in the bag…one in five (20.2%) shops Walmart most often for Groceries, followed by Kroger (6.9%), Publix (3.8%), Shoprite (3.3%), and Safeway (3.1%).

Walmart is also sitting pretty over in Health & Beauty Care…nearly a third (30.2%) shops the big discounter for soaps, shampoos and such, while CVS (12.9%), Walgreens (10.3%), Target (7.5%), and Rite Aid (4.2%) round out the Top 5.

For the third consecutive month, consumers choose CVS (18.9%) over Walgreens (16.3%) for their Rx needs…Walmart (11.7%) holds third place for Prescription Drugs, while Rite Aid (6.4%) and Target (3.2%) follow.

|

|

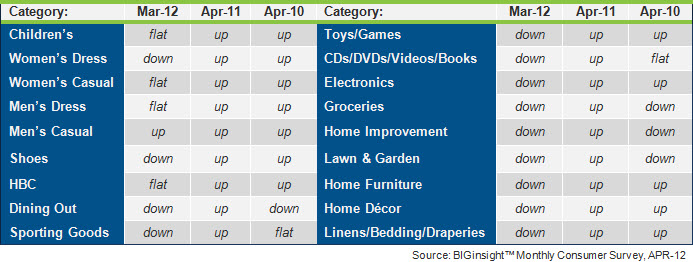

With flatlining confidence, strong focus on needs, and decreasing overall spending at the forefront, consumers exhibit restrained spending plans compared to March, according to the BIGinsight™ Diffusion Index. While all categories improve 90 days forward compared to Apr-11, this month’s results are mixed compared to Apr-10. And, all categories to index DOWNward compared to pre-recession Apr-07.

Retail Merchandise

Categories - 90 Day Outlook

(Apr-12 compared to Mar-12, Apr-11, and Apr-10)

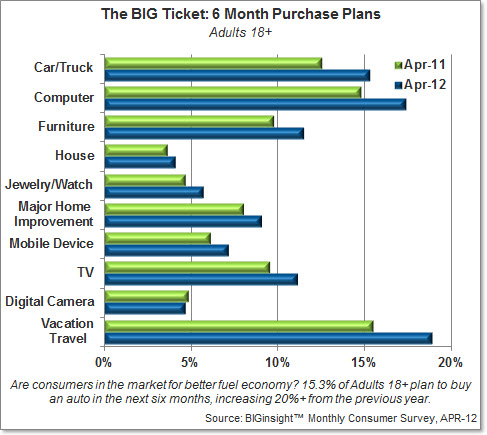

Are consumers in the market for better fuel economy? 15.3% plan to buy and auto in the next six months, increasing 20%+ from the previous year. Additionally, it appears that consumers have some other long-term spending plans on the horizon, as six month purchase intentions rise for computers, furniture, jewelry, major home improvement, mobile devices, TVs, and vacation travel as well. Stay tuned to see if pump prices derail these high-dollar buying plans.

And, for more on new technology and mobile devices, check out the BIG Consumer Blog: Battle of the Sexes: Keeping Up with the (Mobile) Joneses.

|

|

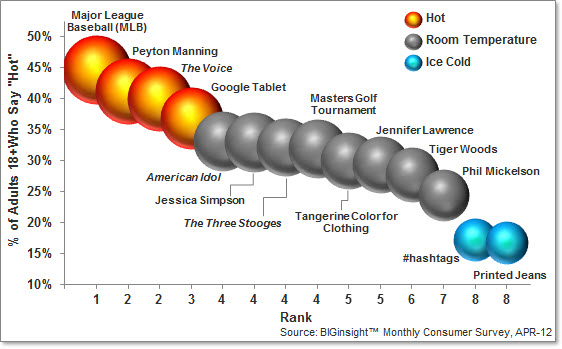

Play ball! Major League Baseball tops our list of what’s hot this month, followed by Peyton Manning, The Voice, and the rumored Google Tablet (though that’s relatively cool compared to the Apple iPad 3, which registered near boiling on the heat-o-meter last month)…Jennifer Lawrence is the “girl on fire” among those under 35, while men are looking forward to the new Three Stooges movie [insert eye roll here]. What’s Not? When choosing a spring trend to follow, it’d be better to try Tangerine colors; this month, Printed Jeans registered as a #fashionfail.

Editor

BIGinsight™ is a trademark of Prosper Business Development.

400 West Wilson Bridge, Suite 200, Worthington, Ohio 43085

614-846-0146 • FAX 614-846-0156 • info@BIGinsight.com

follow us...

![]()

We welcome and appreciate the forwarding of our Executive Briefings in their entirety or in part with proper attribution.

© 2012, Prosper®