|

|

|

|

|

|

|

|

|

|

|

_

Additional Insights:

|

|

The Monthly Consumer Survey from BIGinsight™ monitors over 8,000 consumers each month providing unique

insights & identifying opportunities in a fragmented and transitory

marketplace.

Talking Points:

- Consumers show a little more love for the economy in February

- Have New Year’s resolutions already been abandoned? Practicality, Focus on Needs drop

- Consumers less inclined to curtail spending, but paying down debt remains the priority

- Savers feel more confident in piggy bank balances v. Feb-11

- Kohl’s takes the helm this month in Women’s Clothing

- Consumer Migration: Electronics

- CVS bests Walgreens in Prescription Drugs

- 90 Day Outlook brightens for all categories, continues DOWN compared to pre-recession

- What’s Hot? Adele…Volkswagen…Red Carpet Fashion

|

|

Consumers are showing a little more love for the economy, as a third of consumers (33.1%) indicated they were very confident/confident in chances for a strong economy in February, rising about three points from last month (30.4%) and the highest reading we’ve seen since Jan-08 (33.5%). [Note: Apr-10 was a close call at 32.9%.] But let’s keep our head out of the clouds here…the current level of confidence is still nearly 40% below those heady pre-recession days (Feb-07 = 53.2%).

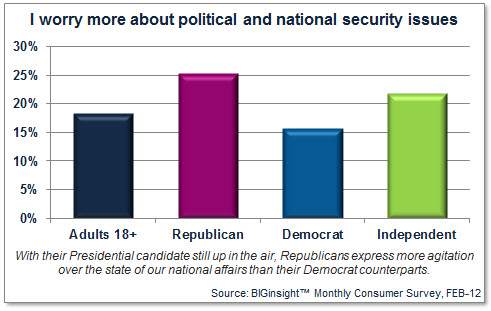

Presidential elections can inspire confidence or concern, depending on who ends up governing from the Oval Office, but it appears that the public at large is saving these emotions for the weeks leading up to November 6. This month, fewer than one in five (18.3%) report that they worry more about political and national security issues, down from 19.0% in January and the lowest reading we’ve seen for more than a year (Jan-11 = 17.7%). This data does get interesting, though, when we split it across party lines:

Have the New Year’s resolutions already been abandoned? In February, two in five (41.9%) indicate that they have become more practical with their purchasing, a six point drop from last month (47.8%) and the lowest level we’ve recorded since early ’08. Stay tuned in coming months to see if consumers continue to see a Spring in their spending, or if they are headed back into hibernation.

Similarly in style, consumers seem to have a touch of Spring fever when it comes to focusing on needs over wants…this month, nearly half (49.6%) say they zero in on just the necessities when at the store, declining about eight points from January and also echoing figures we last saw back in the first few months of 2008.

|

|

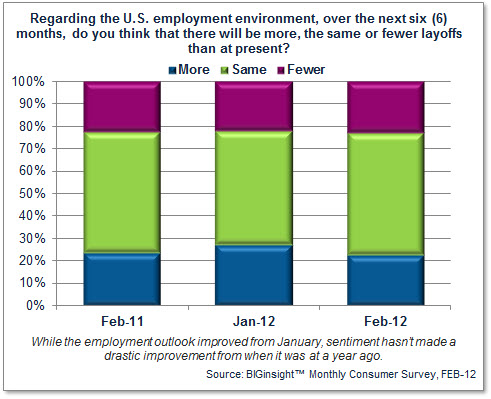

Perhaps it’s employment that’s helping to buoy morale this month…with the official* U.S. unemployment rate recently declining for the fifth consecutive month, consumers are a little less wary about the job market compared to 30 days ago. While nearly a quarter (22.9%) still asserts there will be “more” layoffs over the next six months, this figure has declined a few points from January (27.0%). The majority of consumers (54.3%) maintain that layoff levels will remain the “same” (versus 51.0% last month), while 22.8% are optimistic for “fewer,” up a point from January (21.9%).

* Recall that the official U.S. unemployment rate does not account for discouraged workers or those underemployed.

But don’t break out the bubbly just yet…this month’s employment readings are relatively on par from a year ago, and, of course, with almost four out of five consumers expecting “more” or the “same” number of layoffs for the first few quarters of 2012, we aren’t out of the woods just yet.

Good news for retailers hoping to capitalize on Valentine’s Day shopping, after severely shoring up spending following the holiday season, consumers are less inclined to curtail expenditures in February…currently, just over a quarter (28.4%) maintain plans to decrease overall spending over the next three months, dropping seven points from January (35.5%). Consumers haven’t completely lost their financial focus…more than one in three (34.3%) plan to pay down debt, down just a point from last month (35.3%) and February’s top financial plan. About three in ten (28.2%) plan to increase their savings, while one in five (18.7%) is inclined to pay with cash more often.

In addition to employment, consumers’ more positive mood for February may have a little to do with the balance in their savings accounts…this month, nearly a third (31.1%) said they strongly agreed/agreed that they were saving enough to meet future needs, up from 27.6% a year ago. Bear in mind, though, that a greater number of consumers (38.6%) strongly disagreed/disagreed that they were putting enough away in their piggy banks; however, this figure did decline from Feb-11 (41.9%).

While gas prices continue to hover in the mid-$3/gal range, drivers are bracing for the cost of fueling up to rise, which could affect spending into March…three in five (63.3%) are expecting pump prices to increase by the end of February, while about a third (32.9%) thinks they have topped off for the time being. Both figures eclipse the scant amount (3.8%) who are hopeful that prices will head southward by February 29. Consumers are anticipating an average price of $3.69/gal at the close of the month.

With $3/gal the average tipping point, drivers already have smart spending strategies in place to cope with current pump prices…this month, two in five (39.8%) say they are simply taking fewer shopping trips, while nearly as many are shopping for sales more often (39.1%) and shopping closer to home (39.0%). Penny pinchers continue to show their love for clipping coupons (37.0%) and buying store brands/generic (32.5%) in February as well.

|

|

The catfight continues in Women’s Clothing, as Kohl’s helms the category this month with 10.9% shopping there most often. Former #1 Walmart (9.8%) is a close second place, while Macy’s (7.3%), JC Penney (7.2%), and Target (2.6%) round out the Top 5.

Walmart wins over in the Men’s section, though…the big discounter leads here with 13.7% shopping most often. Rival Kohl’s (10.5%) is second…JC Penney (9.2%), Macy’s (6.0%), and Target (2.8%) complete the Top 5.

And, we’ll complete our apparel tour with a quick look at Children’s…one in ten (11.3%) shop most often at Walmart for les petits bébés…Kohl’s (5.5%), Target (4.8%), JC Penney (3.8%), and Macy’s (2.2%) follow.

With Payless less than a point behind, Walmart isn’t exactly hot-to-trot in Shoes, but a win’s a win…this month, 9.4% say they shop the big W most often, followed closely by discount specialty Payless (8.8%). Kohl’s (6.1%), DSW (4.3%), and JC Penney (3.4%) round out the Top 5.

A big box continues to best a big discounter in Electronics…one-third of consumers (33.3%) heads to Best Buy most often for items like TVs, computers, DVDs, and video game consoles, while Walmart finishes a respectable second place (18.7%). Amazon.com (6.4%), Target (3.3%), and Sears (1.8%) follow in the single digits.

Why buy at a particular store for Electronics? Nearly three-quarters (72.4%) indicate that price is the top motivation. Selection (53.9%), location (41.4%), quality (36.9%), and service (25.7%) are other top reasons, while retailer trustworthiness (19.9%), knowledgeable salespeople (18.2%), and in-store experience (17.9%) prove popular as well.

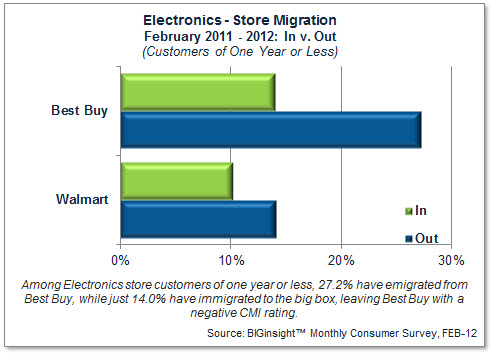

With their large leads, it’s apparent that Best Buy and Walmart won’t be upstaged in Electronics anytime soon, but according to this month’s Consumer Migration Index (CMI), the two retailers might need an upgrade if they expect to retain customers for the long term. The CMI, which tracks those who have immigrated to a store (new customers within the past year, “In”) against those who have emigrated (left within the past year, “Out”) and where a positive rating spells net growth to a retailer, computes a double digit customer deficit for Best Buy (-13.3). Walmart (-3.9) is seeing negative customer growth as well:

What would cause shoppers of one year or less to switch stores? High prices (28.8%) are the top culprit, followed by inconvenient location (17.3%), and poor selection (9.4%). Interestingly, two in five (39.5%) of these consumers cite “No Preference” as to the store they shop most often for Electronics (compared to 21.4% among the general population). Perhaps these fickle shoppers are more concerned with comparing prices than store loyalty. Click over to the BIG Consumer Blog for some interesting evidence on this topic: An Amazonian Sized Challenge: The Smartphone and Tablet Price Check Era.

Is there a battle brewing over in Linens/Bedding/Draperies? While Walmart leads in February with 17.0% shopping there most often, this figure has declined two points from Feb-11 (19.8%). Bed Bath & Beyond (14.8%) is two points behind the big discounter this month, but the big box has increased its share from a year ago (13.8%). JC Penney (7.2%), Target (6.4%), and Kohl’s (4.8%) complete the Top 5.

Over in Sporting Goods this month, Dick’s (14.1%) has outscored Walmart (12.5%) for just the second time in BIG history (the first? Nov-11). Sports Authority (5.5%), Academy (3.3%), and Big 5 (3.2%) follow.

Walmart’s still got game over in Groceries, though…with 17.8% shopping there most often, the big discounter bests traditional grocers Kroger (7.2%), Publix (3.6%), Shoprite (2.7%), and Safeway (2.6%).

The big W is also sitting pretty over in Health & Beauty Care…one in four (25.9%) shops Walmart for soaps, shampoos, and such, more than double the share of nearest competitor CVS (10.1%). Walgreens (8.8%), Target (6.5%), and Rite Aid (3.4%) complete the Top 5.

It seems that Walgreens’ loss of its Express Scripts business (as well as the three other items discussed over in our recent blog post #FYU) has cost the retail giant its top position forPrescription Drugs…in February – and for the first time in our survey’s history – 17.2% cited CVS as the store they shop most often for Rx medications, ahead of the 15.2% who get their [re]fill at Walgreens. Walmart (11.8%), Rite Aid (5.8%), and Target (2.8%) follow.

|

|

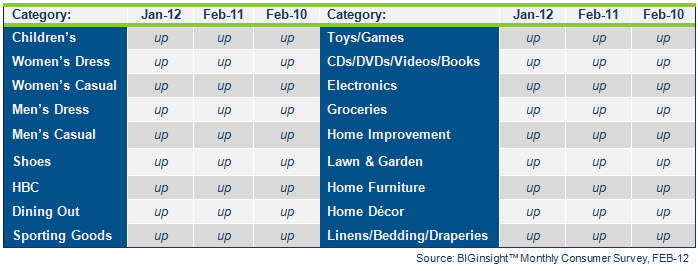

The boost in confidence this month combined with deflated pragmatism appear to have spending plans looking UPward according to the BIGinsight™ Diffusion Index…intent to spend for all categories, including apparel, health and beauty, dining out, electronics, as well as household improvement and décor, improves from January as well as the past two years. This month’s results, though, are tempered by the fact that ALL categories failed to improve from pre-recession Feb-07.

Retail Merchandise

Categories - 90 Day Outlook

(Feb-12 compared to Jan-12, Feb-11, and Feb-10)

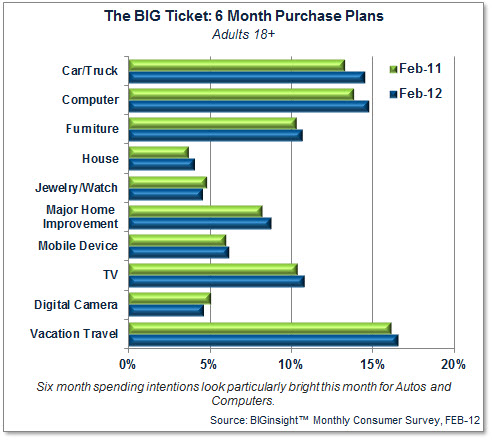

The outlook for BIG Ticket items continues to be optimistic, as six month purchase plans improve from Feb-11 for the following high-dollar durables: Autos, Computers, Furniture, Major Home Improvements, TVs, and even Vacation Travel:

|

|

Adele set fire to our list of What’s Hot this month…the singer-songwriter is followed by Volkswagen (who doesn’t love those Star Wars-themed Super Bowl ads?). Academy Award Red Carpet Fashion, the Award Ceremony itself, and CNN Silver Fox news anchor/newly-minted talked show host Anderson Cooper are tightknit at the top of the list as well. The Jason Wu capsule collection for Target and the Spring headband trend particularly appealed to young women 18 to 34. What’s Not? Rising star Rooney Mara…but perhaps we’re just waiting to see what The Girl with the Dragon Tattoo nominee wears on the OSCAR® red carpet.

Editor

BIGinsight™ is a trademark of Prosper Business Development.

400 West Wilson Bridge, Suite 200, Worthington, Ohio 43085

614-846-0146 • FAX 614-846-0156 • info@BIGinsight.com

We welcome and appreciate the forwarding of our Executive Briefings in their entirety or in part with proper attribution.

© 2012, Prosper®