|

|

|

|

|

|

|

|

|

|

|

_

Additional Insights:

|

|

The Monthly Consumer Survey from BIGinsight™ monitors over 8,000 consumers each month providing unique

insights & identifying opportunities in a fragmented and transitory

marketplace.

Talking Points:

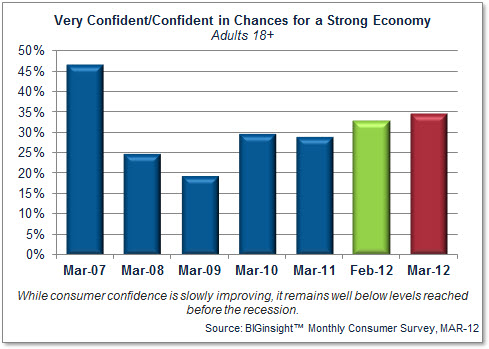

- Confidence continues to climb in March, though still well below pre-recession levels

- February’s spending empowerment fizzles – Practicality is UP

- “Save-not-Squander” is the financial mantra this month

- Newest apparel trends and styles important to record number of shoppers

- Kohl’s wins over Walmart in Women’s Clothing

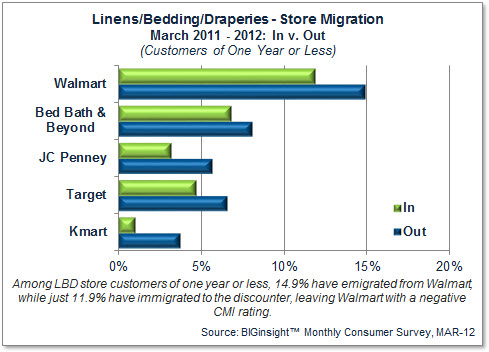

- Consumer Migration: Linens/Bedding/Draperies

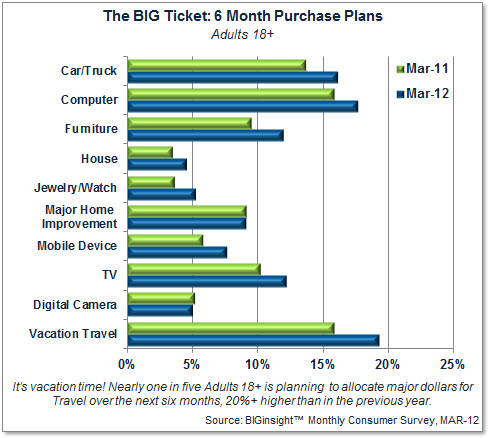

- BIG Ticket: Why is Vacation Travel looking upward over the next six months?

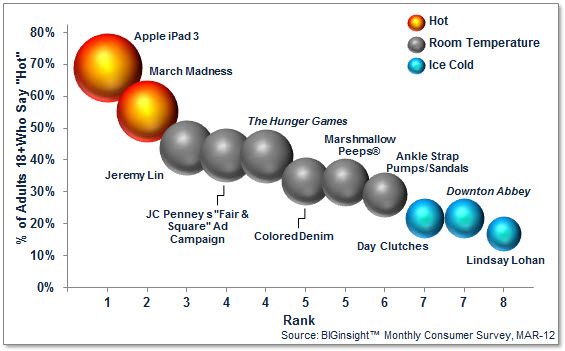

- What’s Hot? It’s a good thing those Apple rumors turned out to be true…

|

|

Confidence continues to climb in March…more than a third (34.8%) say they are very confident/confident in chances for a strong economy, up more than a point from February (33.1%) and rising nearly 20% from a year ago (29.1%). This month’s reading is also the highest recorded since the very beginning of the recession (Dec-07 = 37.0%).

While nearly half of consumers say that trust in the stability of the national economy has the most influence on their economic sentiment, consumer confidence can mean many things to many people, particularly by generation…read the blog: Confidence Defined.

Is concern for political and national security issues ramping up in anticipation of the Presidential election? This month, one in five (20.7%) is worrying more about matters on Capitol Hill, up two points from February (18.3%) and on par with Mar-11 (21.0%). At any rate, consumers seem to be in a slightly better state of mind than they were headed into ’08 Presidential election (Mar-08 = 22.3%).

The spending empowerment we saw in February seems to have fizzled faster than spring daffodils on a 75 degree day [which is what we’re experiencing right now in central Ohio #notcomplaining]…the majority of consumers (51.3%) indicates that they’ve become more practical in their purchasing, rising almost 10 points from last month (41.9%) and trending slightly ahead of Mar-11 (48.2%).

Expect more consumers to stick to their shopping lists, as those focused on needs over wants spiked over the past 30 days…this month, 56.8% are honing in on just the necessities when at the store, up six points from February (49.6%) and rising just a point from last year (55.8%).

|

|

With the official U.S. unemployment rate holding steady at 8.3% from January to February, consumers grow a little more weary regarding their stance on layoff levels…this month, more than one in five (23.9%) predicts there will be “more” layoffs over the next six months, rising a point from February (22.9%). The majority (53.2%) contends that pink slip levels will remain the same, down slightly from last month (54.3%), while 22.9% are hopeful for a decline in the number of layoffs, flat from February (22.8%).

Following NRF/BIG data indicating that a record number plans to plow tax refunds into piggy banks, consumers seem resolute in March to make good on this save-not-squander intention… while paying down debt (34.6%) remains the top financial plan over the next three months, nearly as many (32.4%) will decrease overall spending, up four points from February (28.4%). Three in ten (29.9%) plan to increase savings – rising from 26.8% a year ago – and one in five (21.3%) intend to pay with cash more often.

Gas prices inching ever-so-closely to $4/gal aren’t passing by drivers unnoticed…among the more than 75% of consumers affected by pumped up pricing, half (50.9%) say they will simply drive less in order to cope with the increasing cost, rising from 40.3% in February. Drivers will also attempt to defray fueling expenses by reducing dining out (40.6%), decreasing vacation travel (37.1%), spending less on clothing (33.5%), and delaying major purchases (25.9%).

For more evidence on why consumers are curbing spending, read on: three out of four consumers (76.9%) believe that pump prices will continue to rise through the end of the month. Just one in five (19.7%) think’s they’ll remain steady, while a scant few (3.4%) are not in touch with reality positive about a price decline. Consumers’ pump price prediction for the end of March averages $4.08/gal, which is sobering considering that their close-of-February forecast ($3.69/gal) didn’t veer too far from reality ($3.78/gal*). *Source: U.S. Energy Information Administration.

For more on this subject, head over to the BIG Consumer Blog: Pain at the Pump: At Least Gas Prices Aren’t $5/Gallon…Yet.

|

|

Consumers are focused on shoring up spending, but that doesn’t mean that it’ll take a toll on good fashion sense…this month, more than one in five (21.9%) say newest trends and styles are important to them when it comes to clothing, up from 17.4% in Mar-11 and a new high…what’s really interesting is that just 7.2% felt this way in Mar-02 – that’s a 200% increase in fashion converts over the past decade! The largest proportion of consumers (42.1%) still says that value and comfort trumps trends and styles, while 36.0% prefer at traditional, conservative look…but we’ll see where these folks stand in another ten years.

While the vast majority of shoppers “usually” (63.9%) or “only” (20.6%) buys clothing on sale, a growing number of consumers (15.6%) indicates that sales aren’t important – a figure that hasn’t been this high since the very early months of the recession. Does this mean that a shopping spree is in order? Certainly not, considering current gas prices and conservative financial plans…look for shoppers to gravitate toward quality over quantity as they accessorize existing wardrobes…a little EDLP may be in order as well.

Great fashion + budget-friendly pricing = success for Kohl’s in Women’s Clothing…this month, 12.3% shop the department store darling most often, ahead of Walmart (11.2%) for the second consecutive month. Macy’s (8.3%), JC Penney (7.8%), and Target (3.1%) complete the Top 5.

Over in Men’s Walmart wins with 14.9% headed there most often...Kohl’s (12.8%), JC Penney (10.2%), Macy’s (7.3%), and Target (3.2%) follow.

Taking cues from the likes of Target and Kohl’s with its discount/designer mash-ups, Payless helms the Shoe category with 10.9% shopping there most often. Walmart isn’t far behind with 10.3%, while Kohl’s (6.9%), DSW (4.9%), and JC Penney (4.3%) round out the Top 5.

With three out of four consumers (75.7%) most motivated by price when it comes to shopping a particular store for Linens/Bedding/Draperies (LBD), does it come as any surprise that Walmart leads this category? One-fifth (19.3%) shop the big discounter most often, while Bed Bath & Beyond (15.5%) is in a strong second place position. JC Penney (8.3%), Target (7.0%), and Kohl’s (5.8%) complete the Top 5. Selection (52.3%), quality (44.0%), location (38.9%), retailer trustworthiness (17.8%), and in-store experience (15.4%) follow price as top reasons to shop.

While Walmart and Bed Bath & Beyond both have quite the lead over their competition in LBD, according to this month’s Consumer Migration Index (CMI), the big discounter may have to watch its rearview for a potential passing by big box BB&B...the CMI, which tracks those who have immigrated to a store (new customers within the past year, “In”) against those who have emigrated (left within the past year, “Out”) and where a positive rating spells net growth to a retailer, shows that while BB&B suffers from a slight customer deficit (-1.2), Walmart (-3.0) has lost a greater proportion of shoppers within the past year:

What drove shoppers of one year or less from their previous LBD store? More than a quarter (27.5%) cited high prices…inconvenient location (12.4%) and poor selection (10.4%) followed.

While traditional grocers overall (58.4%) are shopped more often for Groceries compared to discounters (24.4%), Walmart’s lead is in the bag for this category, specifically speaking…the complete Top 5: Walmart (20.3%), Kroger (7.6%), Publix (4.3%), Safeway (3.1%), and Shoprite (3.0%).

Nearly one in three (31.8%) shop the big W most often for Health & Beauty Care, more than double the number who head to CVS (12.4%) for soaps, shampoos, and such. Walgreens (10.0%), Target (8.1%), and Rite Aid (4.4%) follow.

For the second month in a row, CVS (20.3%) bests Walgreens (18.5%) in the Prescription Drugs category…Walmart (11.7%), Rite Aid (7.3%), and Target (3.1%) round out the Top 5.

|

|

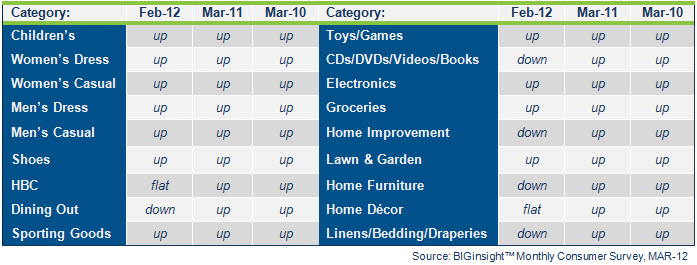

Improving economic sentiment seems to be keeping spending from being completely stifled in March according to the BIGinsight™ Diffusion Index…the 90 Day Outlook is a little mixed compared to February as consumers err on the side of pragmatism, though all categories improve versus the past two years. Keep in mind, though, that any positive news here is tempered by the fact that spending continues to look DOWNward compared to pre-recession Mar-07.

Retail Merchandise

Categories - 90 Day Outlook

(Mar-12 compared to Feb-12, Mar-11, and Mar-10)

Looking ahead over the next six months, shoppers see some spending in their future as most BIG Ticket items, including Autos, Computers, Furniture, Jewelry, Mobile Devices, and TVs, improve from Mar-11. Interestingly, intent to spend on high dollar Vacation Travel rose 20% over the previous year…two theories for this: 1.) Perhaps more consumers are boasting travel plans for 2012, or 2.) Maybe budgets are ballooning to cope with rising pump prices [read: what was once deemed “economical” travel for some is now considered “high dollar” – a major expenditure.]

Thinking about breaking for spring? The BIG Consumer Blog has some ideas for travel: State Superlatives: Dreamiest Destination, Finest Fare, Best Bet for a “Rerun” + more.

|

|

It’s a good thing that there was truth behind those iPad 3 rumors…Apple’s latest incarnation of the popular tablet device is what’s hot this month! March Madness and Jeremy Lin are also top seeds in consumers’ brackets. Additionally, those under 35 are eagerly anticipating the first installment of The Hunger Games trilogy, while Ankle Strap Pumps/Sandals and Colored Denim are adored by all the ladies. What’s Not? Lindsay Lohan…while Debbie Harry’s [alleged] doppelganger was a hoot in The Real Housewives of Disney sketch on SNL, adults in general just aren’t ready for this comeback – and that’s no laughing matter.

Editor

BIGinsight™ is a trademark of Prosper Business Development.

400 West Wilson Bridge, Suite 200, Worthington, Ohio 43085

614-846-0146 • FAX 614-846-0156 • info@BIGinsight.com

We welcome and appreciate the forwarding of our Executive Briefings in their entirety or in part with proper attribution.

© 2012, Prosper®