|

|

|

|

|

|

|

|

|

|

|

|

[scroll down for text summary]

|

|

|

|

|

Did the RNC / DNC rhetoric helped to rally consumer confidence in September? 37.9% report they are confident/very confident in chances for a strong economy, up four points from last month and reaching a 2012 high.

Perhaps the robust outlook for the holiday hiring season is brightening consumers’ outlook for the job market…one in five (21.3%) is calling for “fewer” pink slips over the next six months, up from 16.9% in August and 12.8% one year ago. The vast majority of consumers still predicts “more” (24.9%) or the “same” (53.8%) number of layoffs into early 2013.

With the eleventh anniversary of 9/11 passing peacefully, this date seems more likely now to inspire reflection rather than instilling fear…this month, just one in five (20.4%) admits to worrying more about political/national security, down two points from one year ago (22.8%).

Increasing confidence isn’t leading to decreasing frugality in September…about half (49.5%) of consumers remain practical when purchasing, rising six points from August (43.5%) and remaining relatively in line with Sept-11 (51.1%).

With holiday spending plans on the horizon, the majority of consumers (56.8%) is remaining mindful about buying just what they need, up from August (52.0%) and just below Sept-11 (58.4%).

Decreasing overall spending (33.0%) and paying down debt (32.8%) remain fiscal priorities in September, with both up slightly from August. An increasing number of consumers also plan to pad their piggy banks (28.9%) and pay with cash more often (20.0%).

Nearly three-quarters of shoppers continue to say that fluctuating gas prices are impacting their spending…driving less and reducing dining out remain popular options for easing the pain at the pump. Drivers expect average prices to inflate to $3.90/gal by the end of the month, higher than the $3.76/gal expected for the close of August.

Walmart leads this month’s retail roundup, edging out Kohl’s in Women’s Clothing and Payless in Shoes. The discounter is a strong second behind Best Buy in Electronics, while Amazon continues to grow in this category. And, is the Express Scripts debacle behind Walgreens? While still lagging CVS in Prescriptions, the druggist has picked up consumer share versus Aug-12 and Sept-11.

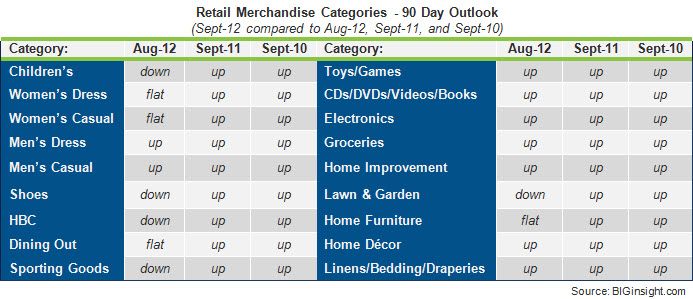

Thoughtful financial plans are evident with a mixed 90 Day Outlook versus last month. Consumers’ more bullish stance on the economy in September – coupled with rising prices across the board – send spending plans upward compared to the past two years. Temper that “recovery” talk, though…spending intentions for the majority of merchandise categories continue to trend downward from pre-recession Sept-07.

Six month purchase plans continue on a positive path, with spending intentions rising for several BIG ticket categories, including autos, computers, mobile devices, and jewelry. Home improvements, TVs, digital cameras are flat, while vacation travel declines slightly.

What’s hot? While it’s that time of year to pass the pigskin, consumers have another competition hot on their minds – the 2012 Presidential election…the Obama vs. Romney bout takes precedence this month over the NFL and fantasy football leagues. And, while new fall fashion includes several “hot” trends, like blazers, hunter green, and vegan leather, it appears that the peplum style won’t make into many women’s wardrobes.

BIGinsight™ is a trademark of Prosper Business Development.

400 West Wilson Bridge, Suite 200, Worthington, Ohio 43085

614-846-0146 • FAX 614-846-0156 • info@BIGinsight.com

follow us...

![]()

We welcome and appreciate the forwarding of the Consumer Snapshot in its entirety or in part with proper attribution.

© 2012, Prosper®